Grab has come a long way since its humble beginnings as MyTeksi, a taxi booking app in Malaysia. Like I mentioned in my GrabPay Hacks article, Grab has diversified into Food Delivery, Insurance, Hotel Booking, Financial Services and Parcel Delivery, among others.

On 24 May 2022, Grab launched a new brand for its financial services, GrabFin where digital payments, insurance, lending and wealth management offerings now fall under. Along with this announcement, Grab introduced a new low-risk investment product to the public, Earn+.

Grab Earn+ has a headlining return of 2 to 2.5%, much higher than its competitors in the space in this semi low interest environment. Syfe’s Cash+ offers a projected return of 1.5% p.a, and Endowus’ Cash Smart offers 1.9% to 2.3% on its Enhanced portfolio.

With such a high expected yield on a product that invests in short term money funds, it would be interesting to see how Grab manages to pull this off. So, I allocated an initial amount of S$1000 on 7 June 2022 to see how far my money will take me.

This is my 21-day experience with Grab Earn+. Note that this article does not constitute financial advice and due diligence should be done before investing in any products. Let’s dive in.

What is Grab Earn+

There are 3 popular financial products to grow your money in the short term with a low risk and medium yield in Singapore: Insurance Savings Plans (ISP), Short Term Bond Funds (STBF), and Money Market Funds (MMF).

Grab Earn+, like Syfe’s Cash+ and Endowus’ Cash Smart, is a Cash Management Portfolio (CMP) that allows you to invest in MMFs and STBFs with no minimum investment, free, unlimited withdrawals, and no brokerage fees.

What differs between them is the composition and type of funds they invest in. These platforms are not insured by the Singapore Depositors Insurance Scheme.

ISPs like the Singlife Account, Dash Pet by Singtel Dash, and Tiq by Etiqa are insurance policies with a heavy savings component. Funds deposited into these companies are managed by the respective companies, either through investments or stored in reserves.

The ISPs mentioned above do not directly invest in any financial instruments, so there is little to no risk of investment losses. They also offer no minimum top ups, free, unlimited withdrawals. ISPs are insured under the Singapore Depositors Insurance Scheme up to S$75k.

Now that we know the differences, it is important to know that we cannot directly compare the returns between ISPs and CMPs, since the latter takes on a higher risk by virtue of investing in the market.

Let’s compare Grab Earn+ instead, with other popular CMPs, namely Syfe’s Cash+, and Endowus’ Cash Smart Enhanced (their midrange portfolio for easy comparison):

| Grab Earn+ | Syfe Cash+ | Endowus Cash Smart (Enhanced) | |

| Projected Annual Return (%) | 2 – 2.5 (Unknown if it is after or before Fee) | 1.5 (After Fees) | 1.9 – 2.3 (After Fees) |

| Fee (%) | 0.59 (Fund Level + Grab’s cut of Fund Fee) | 0.35 (Fund Level) | 0.27 (Fund Level Fee) + 0.05 (Endowus Management Fee) |

| Composition | 50% – Fullerton Short-term Interest Rate Fund 50% – UOB United SGD Fund | 30% – LionGlobal SGD Money Market Fund 70% – LionGlobal SGD Enhanced Liquidity Fund | 50% – UOB United SGD Fund 50% – LionGlobal SGD Enhanced Liquidity Fund |

| Withdrawal Speed | To GrabPay Wallet: Instant To Bank Account: 4 – 5 working days | To Cash Balance in Endowus Account: 3 – 4 working days To Bank Account via Quick Withdrawal (before 11AM SGT): Same Day To Bank Account: 4 – 6 working days | To Bank Account: 2 – 4 working days |

As you can see, all of the management portfolios invest in local financial products listed on the Singapore Exchange, and have more or less similar withdrawal speeds. Fund liquidity wouldn’t be a large issue here.

Unlike ISPs which credit interest on a monthly basis, the value of your portfolio will fluctuate on a daily basis, based on market movements. Don’t be too shocked if your portfolio turns a negative return.

Deposit methods

Just like the rest of the management portfolios, Grab Earn+ don’t support credit card top ups. So while the GrabPay wallet supports using the UOB Absolute Cashback Card to obtain a 1.7% cashback, Grab’s investment portfolio doesn’t

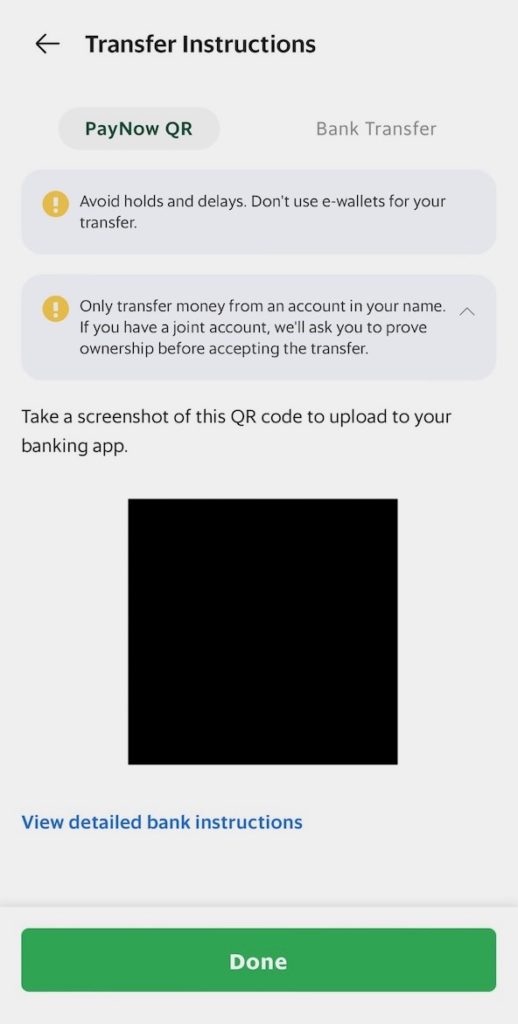

2 Methods are offered to users: Scanning a PayNow QR code with your banking app, or initiating a manual bank transfer to GrabInvest. In case you were wondering, NS55 / HOME credits from LifeSG cannot be utilised with the PayNow QR code. Bummer.

Unlike Syfe and Endowus, GrabInvest doesn’t support transfer of funds to and from another portfolio. This means that Grab’s other portfolio, AutoInvest (1.18% p.a) cannot be used to top up Earn+, while Syfe and Endowus’ can be used to top up their respective CMPs.

Deposits are processed instantly and the Earn+ balance gets updated with the top up amount. It takes about 3 – 5 working days for GrabInvest to purchase the underlying funds to be reflected in your portfolio. The minimum amount needed for a top up is S$1.

Withdrawal

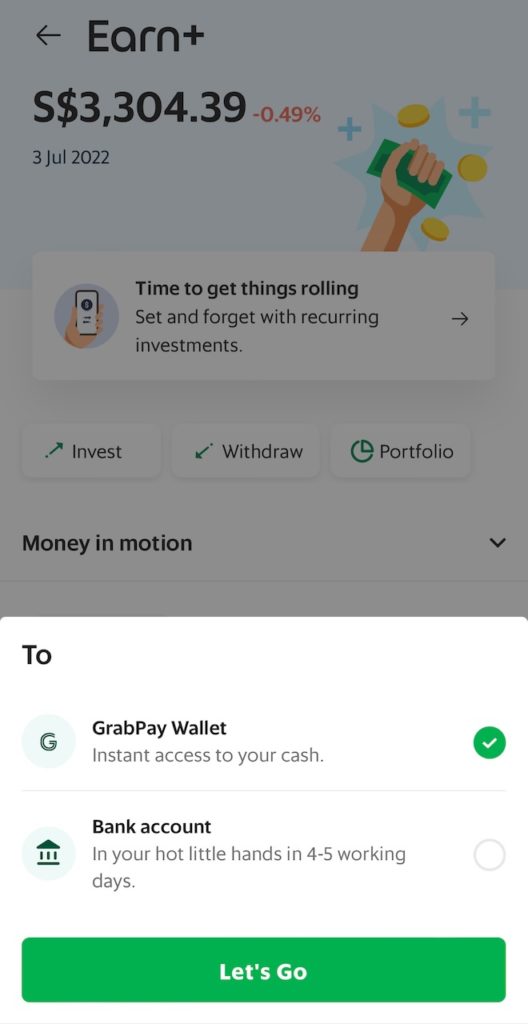

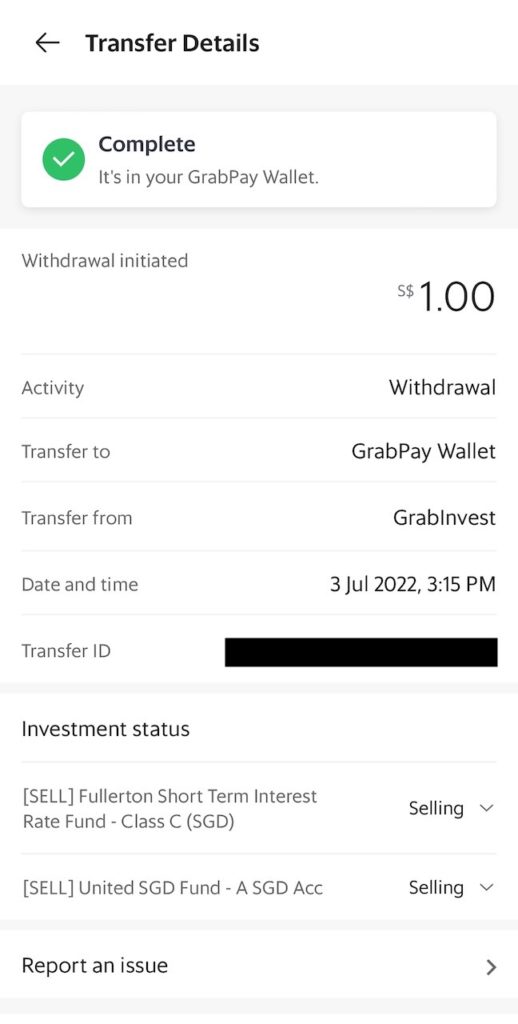

As mentioned earlier, Grab offers 2 methods of withdrawal: To GrabPay Wallet or to Bank Account.

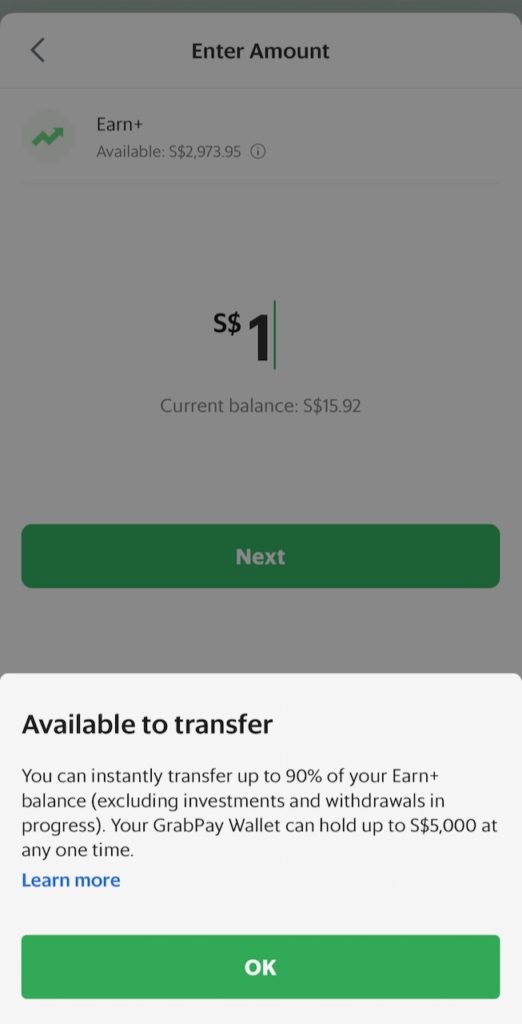

The former method is instant, crediting your GrabPay wallet with essentially an advance from Grab, while they proceed to sell your underlying assets when the market opens. Note that only up to 90% of your portfolio can be withdrawn with this method, and that the GrabPay Wallet can only hold up to S$5000 at one time.

This instant withdrawal trumps the offerings from Syfe and Endowus, where the fastest withdrawal speed is 2 working days. Funds withdrawn from your Earn+ portfolio can then immediately be used for GrabFood, Grab Rides, or even any Mastercard transactions if you own a GrabPay Card.

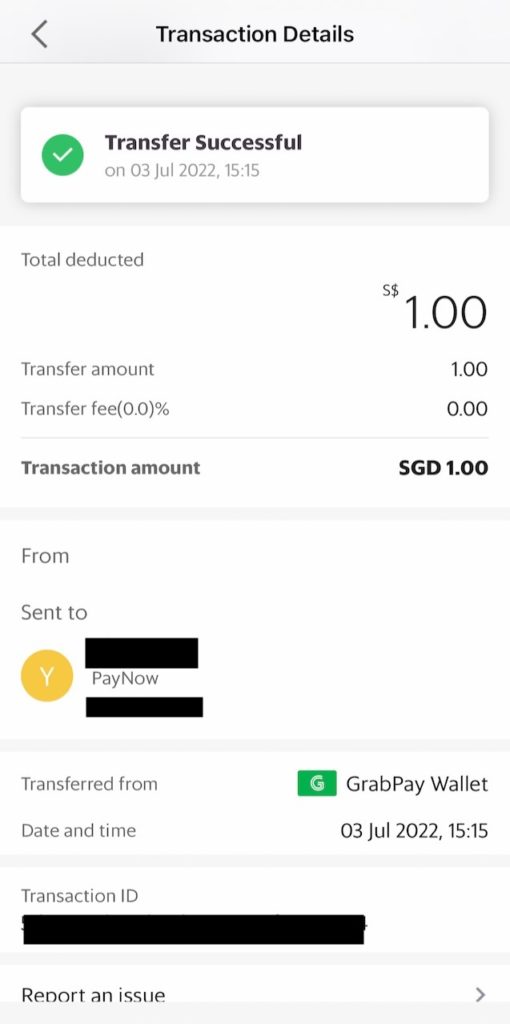

We can take this even further. In my GrabPay Hacks article, I mentioned that funds not originating from Credit Card top ups from the GrabPay Wallet can be withdrawn to your personal bank account via PayNow.

Since GrabPay Wallet top ups from Earn+ (equals to withdrawal to GrabPay Wallet), are not originating from a credit card, we can perform an instant withdrawal of the same balance withdrawn from Earn+, to your linked bank account. Just tap on the “Transfer” tab on the GrabFin page.

This effectively negates the need for the second method of direct bank account withdrawals which takes 4 – 5 working days for the funds to be sold before any crediting is done.

Even ISPs like Singlife, which are famed for their quick withdrawal speeds, take a minimum of 10 -15 minutes for funds to be reflected in your bank account. I’m not sure if Grab intended for this withdrawal method is meant to be used in this manner, but at least it works for now.

Returns

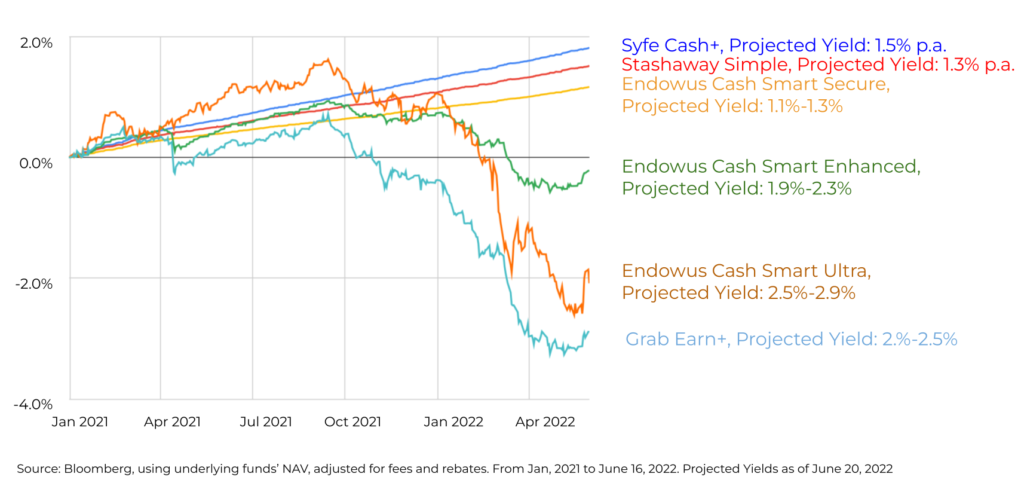

Moving on, the main reason why you are putting your money into Grab Earn is its high projected return when compared to the other CMPs. Let’s take a look at the Graph of actual returns from popular CMPs over 2022.

(Graph from Syfe, with data obtained from Bloomberg)

Fine, this graph is obtained from Syfe, and it might not be the most independent source, seeing how returns of Grab Earn+ is backdated to Jan 2021 (It was only released in March 2022). So I did some digging into the respective performance reports from each Fintech Firm from March 2022 to May 2022.

| Grab Earn+ | Syfe Cash+ | Endowus Cash Smart (Enhanced) | |

| March 2022 Return (%) | -0.19 | 0.11 | -0.71 |

| April 2022 Return (%) | -0.36 | 0.11 | -0.11 |

| May 2022 Return (%) | 0.32 | 0.10 | 0.25 |

| Year to Date (YTD) Return (%) / January 2022 to May 2022 Cumulative Return (%) | -0.25 | 0.51 | -0.65 |

Sure enough, It looks like Syfe’s Cash+ is doing really well with its conservative fund allocations, yielding a year to date return of 0.51%. Again, it is important to take note that for the purposes of discussion, Endowus’ conservative Cash Smart Secure is not included. The YTD return of the Cash Smart Secure is 0.71%.

There is a general trend to the returns by these CMPs in 2022: the higher the projected yield, the worse the portfolio performed. This is because higher risk funds tend to have higher returns, but at the same time more affected by global events like COVID and the Russia-Ukraine War.

All the abovementioned CMPs basically purchase a combination of 2 of 4 common funds: Fullerton Short-term Interest Rate Fund, UOB United SGD Fund, LionGlobal SGD Money Market Fund, LionGlobal SGD Enhanced Liquidity Fund. So, the returns will entirely lie on the fund’s performance, and not that of Grab, Syfe or Endowus, barring fees.

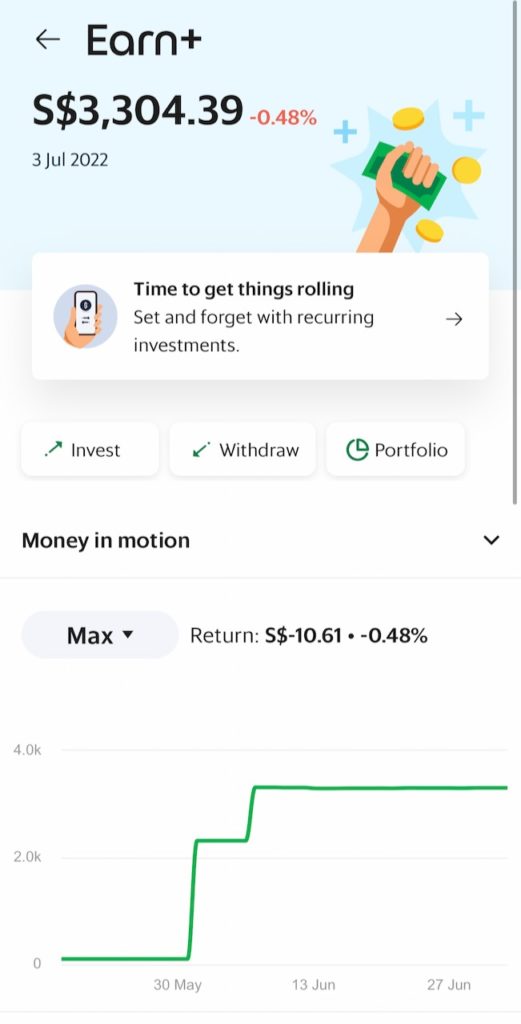

My own return from Grab Earn+ is -0.48% as on 3 July 2022, where I added an additional S$3317 over the course of June.

As Grab Earn+ has only been in the market for 4 months, it is unknown if the high projected return of 2 – 2.5% can be attained. I will update this article with the actual return at the end of the year, so stay updated via our Instagram Page and Telegram Channel.

Conclusion

To answer our question of whether Grab’s Earn+ CMP stays true to its projected yield, it is far too early to tell in the currently extremely volatile market. But as interest rates start rising around the world, returns from Bond and Money Market Funds are likely to increase in the longer term.

Whether Grab Earn+ is a viable option for people looking for a short term cash management portfolio, it heavily depends on risk appetite and the need for fast withdrawals.

If you are looking for the highest return out of the CMPs and are willing to have your portfolio fluctuate by a greater extent vis-a-vis other CMPs, it may be worth the risk for the projected returns. Of course, this is not promised.

Otherwise, look for an ISP like the Singlife Account or PET by Singtel Dash which pay you monthly interest, without having to buy into the market. While the annual returns of ISPs are much lower than CMPs, they spare you the anxiety of looking at a negative portfolio.

If you want to stave off the risk of these fintech products in totality and don’t mind a lower return, look for a high interest bank account like the Standard Chartered Jumpstart (0.5% p.a interest) or OCBC 360 (0.4 – 0.8% for most people).

Anyway, my experience with Grab Earn+ has been great so far. Top ups are instantly updated, and everything with regards to the management portfolio is extensively explained on their FAQ page. The instant withdrawals to my bank account, albeit indirectly, is a huge plus in my opinion.

I can keep my funds allocated to daily spending into Grab Earn+, while spending with a credit card and paying off the bills by instantly withdrawing from Earn+ to potentially earn an extra rebate on my spending.

We can only wait to see if Grab delivers on its claim of 2 – 2.5% return. In the interim, I’m keeping a portion of my savings in Earn+.

Derrick (Yip Hern) founded Tech Composition to provide valuable insights into the tech and finance world. He loves to scour the web for the best deals and embark on software projects during his free time, a typical geek, right?