Everyone in Singapore has either owned or used an EZ-Link card for public transport. But does all that familiarity and nostalgia mean that we should continue using it in 2021, especially with other alternatives readily available? Here are 3 reasons why you shouldn’t.

Worse rewards program

Firstly, while EZ-Link cards are eligible for their in house reward programme, their paltry 1 point per $0.10 spent on public transport is worse than what you can get from using a credit card

Let me illustrate my point with the following assumptions.

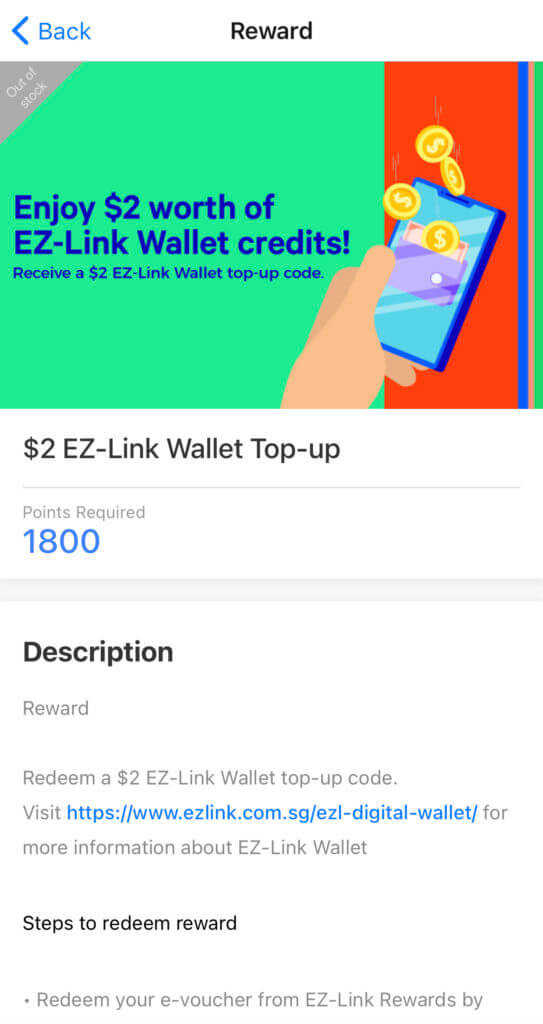

- A quick look at the EZ-Link rewards page shows a redemption for a $2 top requires 1800 points. Hence, the value per EZ-Link point would be $0.0011.

- The following credit cards shown below offer rewards for public transport without minimum monthly spend.

- The value per mile is deemed as $0.019.

- There are debit cards that offer cash back for public transport, but as far as I know, almost all of them require a minimum monthly spend of around $500, so I would not include them in this comparison.

| Amount Spent(S$) | Points/Cash Back/Miles | Estimated value(S$) | |

| EZ-Link (1 point every $0.10) | 100 | 1000 points | 1.1 |

| Standard Chartered Spree Card (2% cash back) | 100 | $2 | 2 |

| DBS Altitude Visa (1.2 miles every $1) | 100 | 120 miles | 2.28 |

What makes this worse is the fact that you are not automatically enrolled into the EZ-Link rewards programme by default. Instead, you have to sign up for an EZ-Link account, enroll your card, only then you would be able to start accumulating points. Just think about how much rewards you have left on the table so far.

For those who have or potentially can have a credit card, the benefits of using credit cards continue. Else, read on to find out more ways why using a debit card can still be better than the traditional EZ-Link, even if you are unable to get the superior credit card rewards.

Requirement to top up

We have always feared this scenario, trying to tap your card onto a MRT gantry during peak periods, but seeing the display transition into a shade of red that your face eventually turns, and showing the dreaded phrase: “Insufficient Value”. The imaginary (or literal on someone’s bad day) stares and the “tsks” would soon follow, as you turn around and walk through the passage of shame to the General Ticketing Machine to top up your card.

Of course, no one wants to be in that scenario. That’s why EZ-Link themselves recently added an auto top up feature. To enable this, you have to of course, sign up for an EZ-Link account and enable it. You can do so either via GIRO or Visa/Master. This however comes with some caveats. The minimum auto top up amount is $20, which may lead to some leftover value if you are not using the card for a period of time. The process of cancelling auto top up is also cumbersome. The FAQ page says that you have to physically head to a TransitLink Ticket Office to do so.

A better alternative is to use your debit/credit card, where public transport fares are directly debited from your card without the need for topping up or remembering to do so in the first place.

The Debiting schedule for each card Type is shown below.

| Card Type | Debiting schedule |

| Visa | Daily |

| Mastercard | Up to 5 days later or when fares accumulate to $15, whichever is earlier |

(The FAQ page did not mention anything about AMEX, but I’ll update the article when I obtain more information)

Risk of losing physical card

Now, the most feared incident that can happen to you, losing or dropping your well loaded card. It scares me to see some of your card values exceeding $100 when I transit. While EZ-Link has their own unauthorised usage protection, card freezing and value transfer programs, their benefits kick in only when you make a police report with the card CAN ID. Even then, the unauthorised usage protection is capped at $15 and the whole process may take multiple weeks.

By using a virtual debit/credit card for transport, which you can do by adding your card to Apple/Google/Samsung Pay, you greatly reduce the risk of losing your card since you don’t have to whip out your physical card every time you tap in and out. EZ-Link does not have this feature currently.

Closing Thoughts

Having heard of all the potential benefits of using your debit/credit card in place of your trusty EZ-Link card like the superior rewards program, not having to top up your card and the added security, would you make the switch? Leave your comments and thoughts below. For instructions on how to make the switch, visit SimplyGo’s FAQ page here.

Derrick (Yip Hern) founded Tech Composition to provide valuable insights into the tech and finance world. He loves to scour the web for the best deals and embark on software projects during his free time, a typical geek, right?

Pingback: Which Is The Best QR Payment Method In Singapore - Tech Composition

Pingback: How To Earn Crypto Everytime You Take Public Transport In Singapore - Tech Composition

Pingback: 5 Apps Every Singaporean Should Have in 2022 - Tech Composition

Pingback: A Comprehensive Guide to Multi Currency Cards in Singapore (2022) - Tech Composition

Pingback: 6 Tech Related Life Hacks You Need To Know As A Singaporean - Tech Composition

Pingback: Tech Composition's 2022 In Review: How It Started And What We Did - Tech Composition