Everything is going digital these days: work meetings, payments, shopping, and even dating. And if you thought things weren’t moving fast enough, COVID happened in 2019.

All of a sudden, everyone was forced to either adopt tech solutions, or slowly fizzle out into the background. Cash was frowned upon as people are more wary of hygiene protocols, shopping moved mostly online, and people created more online accounts than ever.

And that came with some caveats. Scam and Phishing attempts became extremely prevalent, and the multitude of payment options confused many.

In order to properly secure and take advantage of all these technologies in this climate, we compiled a list of tech related life hacks that every Singaporean should know about.

Let’s dive in.

Get Rewarded For Taking Public Transport

As if the impending GST hike to 9% wasn’t enough, Public Transport rates were increased by 3 to 4 cents for adults on 26 December 2021, adding to higher consumer prices.

But did you know that there is a way to earn rewards, or cash back to offset those price increases every time you take the bus or MRT?

No, I’m not talking about the native EZ-Link rewards programme where the best use case for your EZ-Link points is to redeem it for a $2 card top up. This effectively works out to a 1.1% cashback.

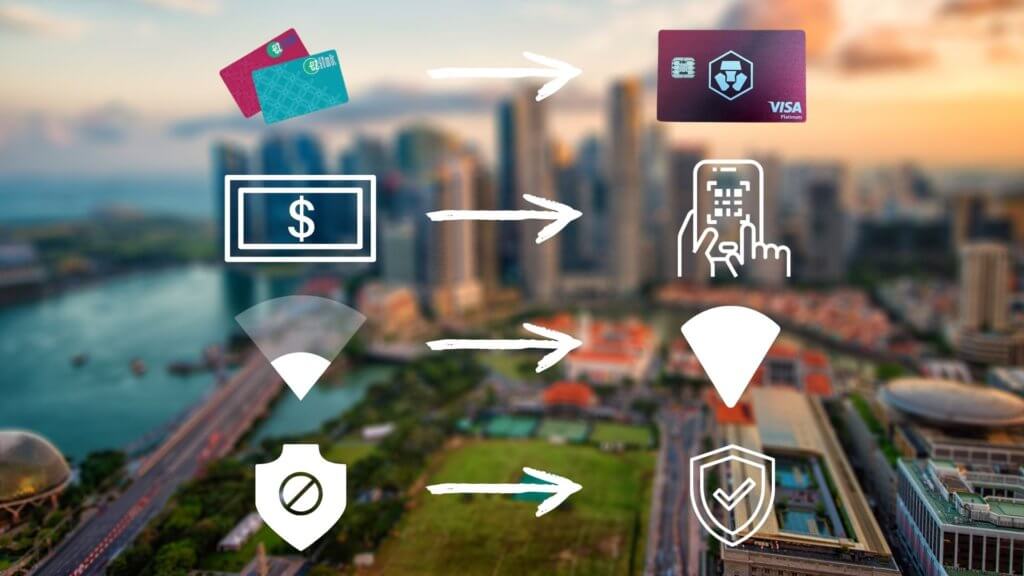

This may seem decent at first glance, but remember, debit and credit cards can be used for Public Transport since 2019. This means the superior card rewards like cashback and miles can be accrued rather than those EZ-Link points.

Bank credit cards like the Standard Chartered Spree card and DBS Altitude card, offer 2% cashback and 1.2 miles per dollar on Public Transport without any minimum spend. Far superior compared to EZ-Link’s own program.

I touch on more benefits of not using an EZ-Link card for Public Transport in this article here, check it out to know more.

Crypto is all the hype now right? What if I told you that even Crypto can be earned, just by taking the train or the bus?

By signing up for a Crypto.com debit card, you can enjoy between 1% to 8% in Crypto cashback, depending on your staked amount (S$0 to S$500,000).

The cashback earned is in Crypto.com native coin, CRO, which can be converted into any other Cryptocurrencies within the app.

Note that Cryptocurrencies are highly volatile and you should do your own due diligence before committing to a stake.

If you wish to know more details and the step-by-step instructions on how to do so, view this article here.

Get The Most Out Of Digital Payments

Like I mentioned earlier, Singapore is rapidly transitioning towards cashless payments. This is no surprise given that Singaporeans have the highest awareness of contactless payments within ASEAN.

Our government and NETS even came up with a way to unify all the different QR codes provided by the different providers, further boosting consumer confidence in using such payment methods.

And if you’re still paying cash for everything, you’re literally leaving money on the table.

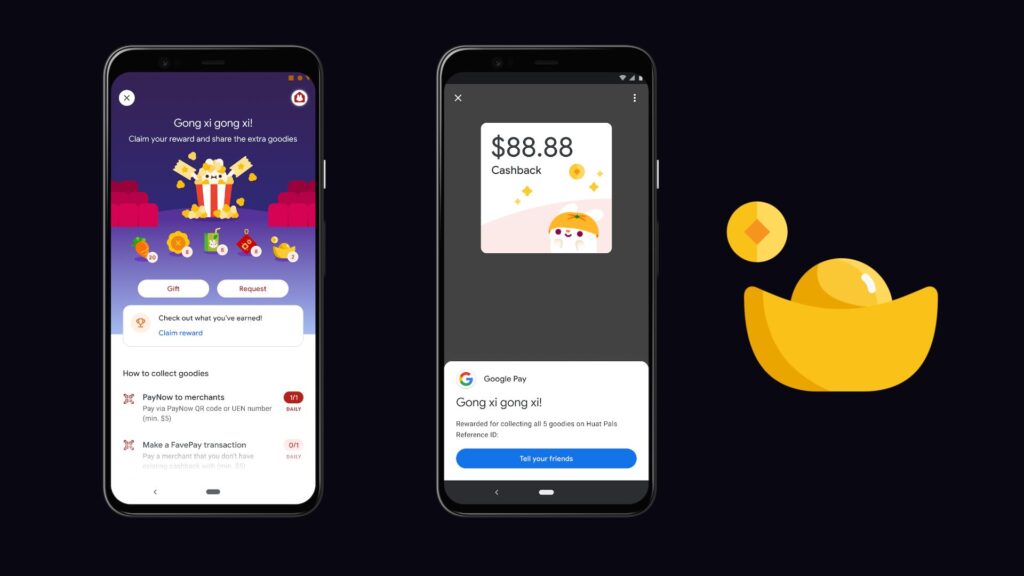

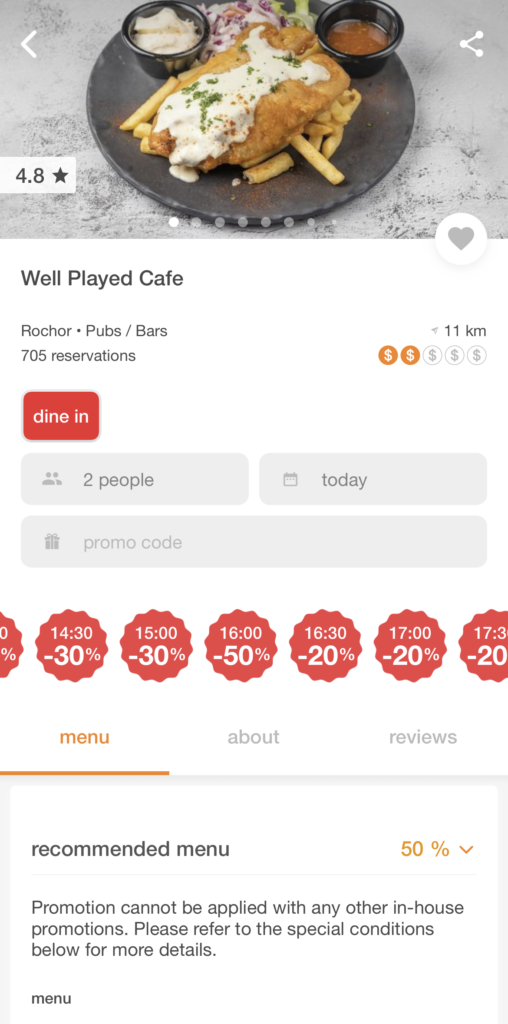

See, fintech firms like GrabPay, FavePay, and ShopeePay reward users with points, cashback, and discounts in order to drive higher adoption rates.

So whenever you see a SGQR, use a QR payment service to get at least something back for your purchase. The alternative is fumbling for cash and not getting any rewards for it.

QR payments can be broken down to mainly Bank-linked and e-wallet linked services.

Bank-linked services like PayLah! PayNow, PayAnyone don’t usually offer any rewards for using them since they already have the lion’s share of the market.

The acceptance of e-wallet linked services are less prevalent than bank-linked services, so they have to play catch up by offering consumers rewards.

So which QR Payment is the best suited for each situation? I go into the nitty gritty details in this post here.

Psst, if you’re already using GrabPay as your main QR payment service, here are 5 hacks you should know about in 2022.

Never Pay Full Price For Online Shopping and Private Hire Cars Rides