Cryptocurrencies made headlines in recent weeks, and it doesn’t look pretty: One of the largest algorithmic stablecoins Terra USD (UST) that was supposed to maintain a peg of 1 UST to 1 USD, failed spectacularly.

1 UST is now worth US$0.12 at the time of writing, and the Crypto pair LUNA that was supposed to buffer any price changes to UST fell from US$80 to US$0.00000099 in the short span of 1 week. Bitcoin also fell below US$30,000 for the first time in almost a year, sparking widespread panic in the markets.

But, this is exactly the kind of risk Crypto investors partake in. The volatile price swings and the risk of black swan events like that of UST and LUNA mean we should keep a close eye on our holdings regularly. There are a few methods we can do so, but which is the best for the everyday investor? Let’s find out the best and worst ways.

Exchange Apps

The easiest way to check your overall profits and losses (P&L) is by directly using the app that you bought your Crypto from. Examples of these would be Crypto.com, Gemini, Coinbase and CoinHako, to name a few.

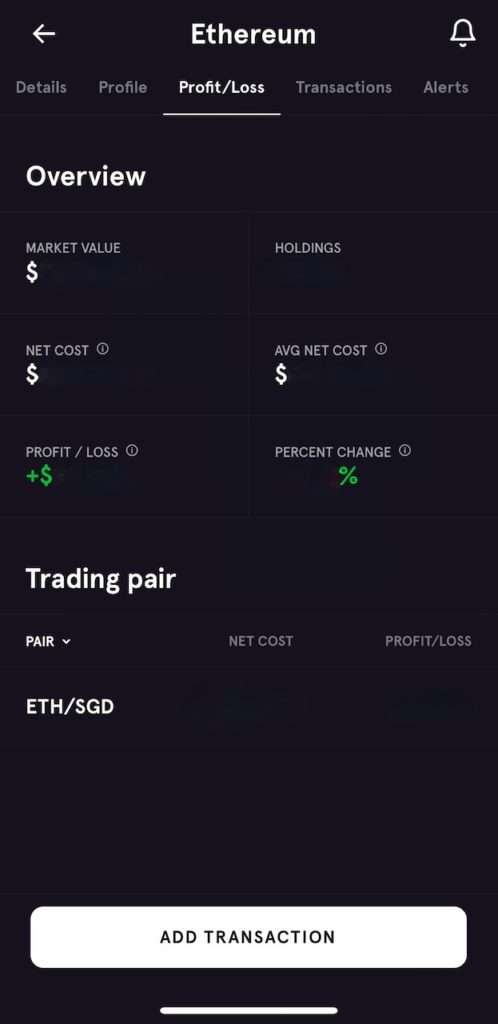

The formula is simple: take the current market value of your holdings minus your initial cost for those coins. Easy right? It is surprising to see most Singapore Crypto Exchanges and Apps omitting this feature.

In order to find out your P&L, you would have to dig through all previous transactions where you bought and sold the coin, deduct fees and deal with decimals. To make matters worse, you have to take into account the different places the coin is stored, be it in a non-custodial wallet or a high yield interest earning account.

The multiple logins needed for the various accounts also pose a challenge for people who always want to keep a tight eye on their holdings at all times. This is especially so for people who participate in Decentralised Finance (DeFi) activities like staking and validating, which adds another layer of complexity to it.

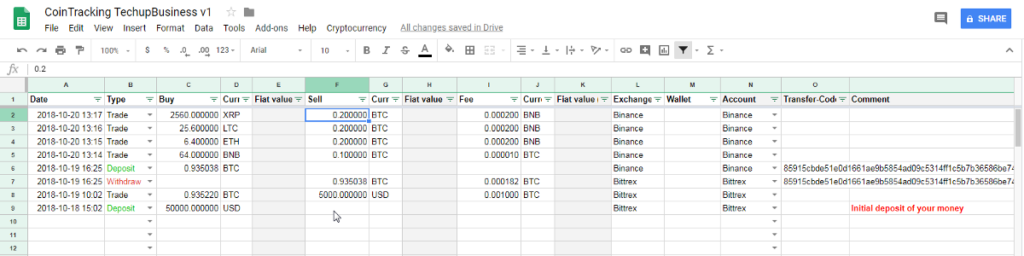

So what’s the next logical step to alleviate this problem when most exchanges don’t look like they are baking in this feature soon? Well, most would turn to creating spreadsheets using Excel or Google Sheets. It’s much better than having to eyeball every transaction, but it has its cons too.

Spreadsheets

Using spreadsheets for recording is pretty simple: Just key in the amount of Crypto you received or used for every transaction and use the =SUM() function to total all your cost holdings.

But there is a slight issue: real-time Crypto prices are not readily provided on these platforms as price data is provided by the exchanges. That means you still do not know how much your Crypto is worth at a certain point in time no matter how nice your spreadsheet looks.

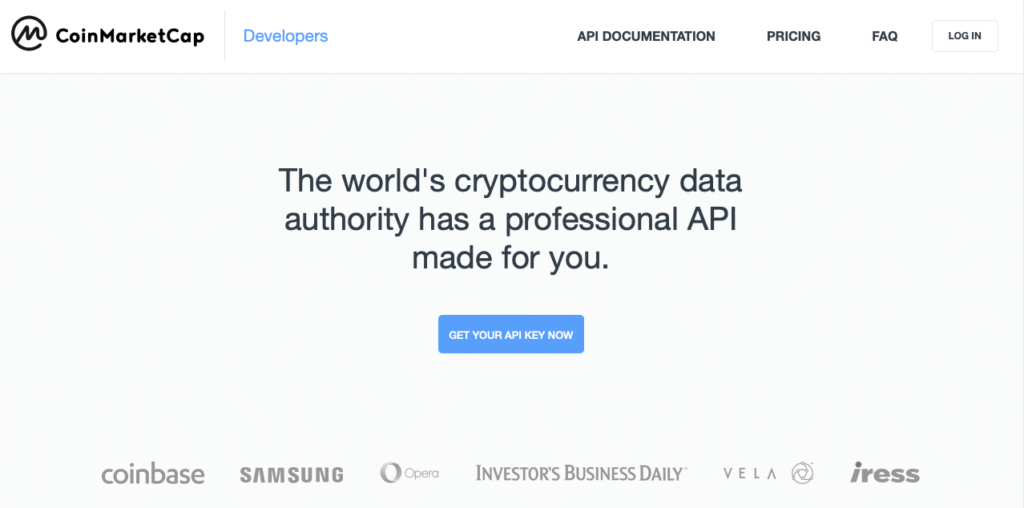

The only way to integrate pricing data into Google Sheets or Excel is to sign up for an Application Programming Interface (API) key from price aggregators like CoinMarketCap or CoinGecko. We don’t want to be Googling the price of our coins every single time right?

An API key allows you to pull pricing data from these websites in real time and display it on your spreadsheet. Even then, some technical know-how is to be expected from you to pull this off.

We’re talking about GET requests and Authorisation Headers. If those phrases seem scary to you, either follow a 30 minute tutorial on YouTube or take the easy way out and look for a portfolio tracking app.

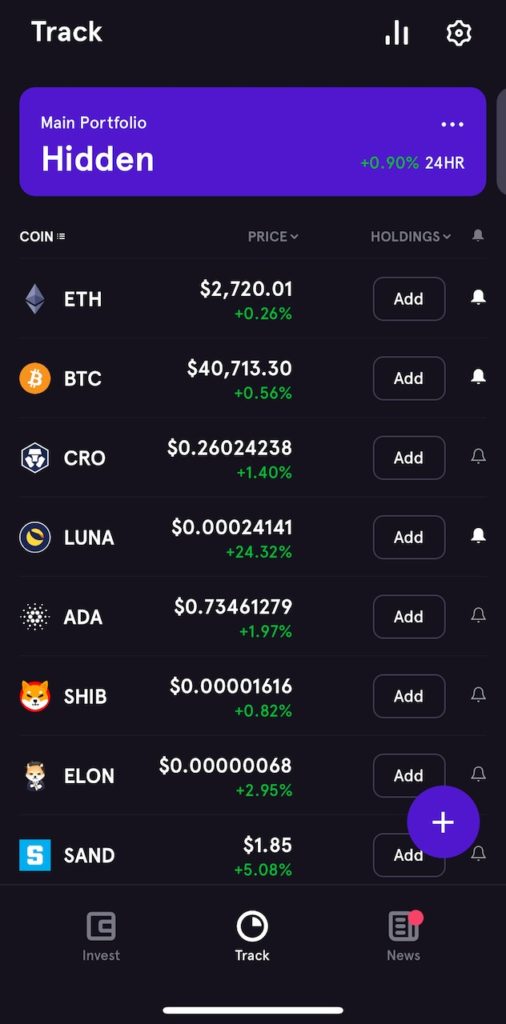

Portfolio Tracking Apps

Ok, let’s get to the best way to track your Crypto portfolio, using specialised Crypto Portfolio tracking apps. These apps are available on the App Store and Play Store and have mainly the same features, differing only in design and speed.

Unlike Spreadsheets where you have to sign up for an API key and write a few lines of code to obtain pricing, Crypto portfolio tracking app eliminates that need as they have already done the legwork for you.

Complicated formulas like net average cost and returns per given period are also available with a click of a button.

And like Crypto exchanges, you can gain access to candlestick charts over different periods for technical analysis and up to date updates for all your different holdings. Best part about this, it is mostly free and gets you the best of both worlds.

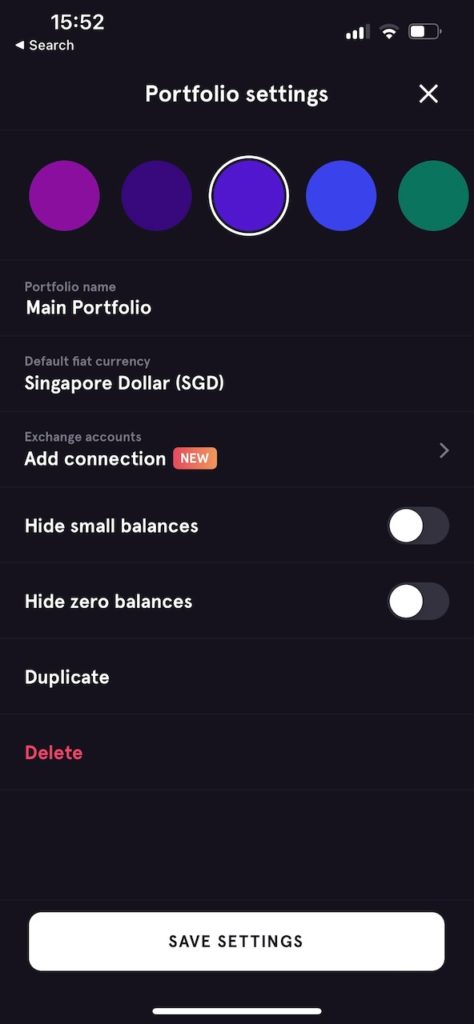

I personally use FTX (formerly known as BlockFolio) to track all my Crypto holdings. Although the app markets itself to be an easy and low cost way to buy Crypto, the tracking features within the app are completely free to use and no KYC is required.

All major Cryptocurrencies and even meme coins with miniscule market caps are available for tracking with price data from a wide range of sources and displayed in the currency you prefer.

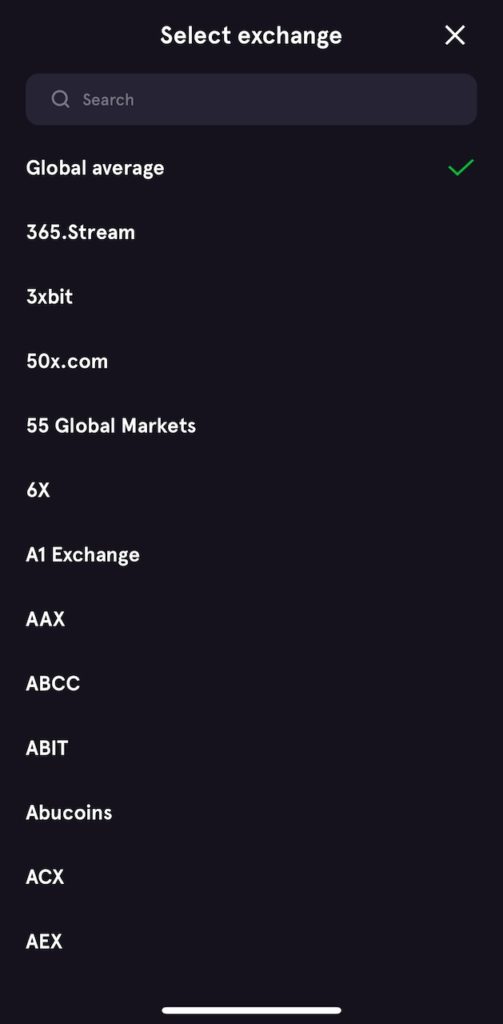

You can even choose the exchange you would like to pull pricing data from, including large exchanges like CoinBase, Binance and you guessed it, FTX Pro. If you want to rely on a mean overview of the price, pick Global Average and it will do the trick.

As mentioned earlier, most portfolio tracking apps including FTX come with real-time P&L calculations as well as your net cost for every coin, taking into account any free Crypto you may have gotten from interest deposits.

Conclusion

Crypto in 2022 looks like it is going for a rough ride with the FED interest rate hikes and a looming recession risk. But there is no doubt Crypto is gaining more traction in the finance space.

From the use of Crypto to load Visa debit cards for public transport, to making money remittance cheaper and quicker, to acting as a hedge against inflation, it is probably worth taking a look at

Of course, this does not constitute financial advice. Whether you are a Crypto trader or HODLer, having a good way to track your portfolio is paramount, lest you get caught up in another black swan event like LUNA and UST.

I would recommend most to use a Portfolio Tracking App for the simplicity, but if you are afraid of data leaks occurring which expose your holdings and email, by all means use a spreadsheet integrated with data via an API of your choice.

Do you have any other ways that enable you to track your Crypto portfolio efficiently or any tips and tricks to make the experience better? Leave them in the comments below.

Derrick (Yip Hern) founded Tech Composition to provide valuable insights into the tech and finance world. He loves to scour the web for the best deals and embark on software projects during his free time, a typical geek, right?

l97s39