It’s literally a week away from the new year. Did you manage to keep your spending within the budget you set in your New Year’s resolution last year?

Yeah, I can sense your sheepish looks already. I get it, the litany of monthly Shopee and Lazada ads plastered everywhere from TV screens to MRT billboards, are invading our subconscious mind.

When you get exposed to these shopping ads so many times a day, it pushes you to buy more things that you don’t need. What even is budgeting anymore?

But this doesn’t have to be the case. Instead of trusting yourself to mentally set a budget to spend every month, why not use an app that reminds you exactly when to stop spending?

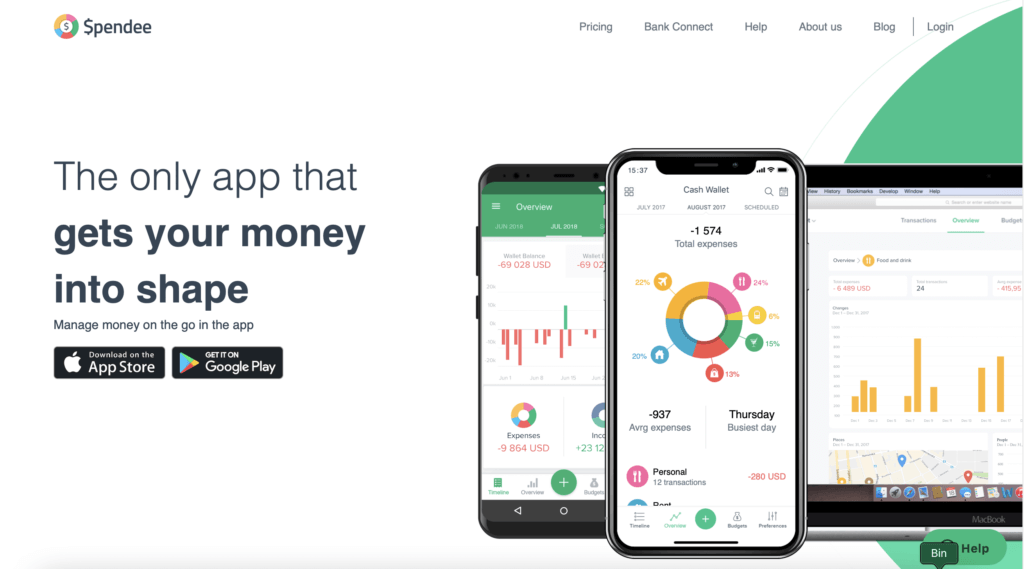

I personally use Spendee, a comprehensive budgeting app. It is available on all platforms, Web, Android and iOS, so your transactions will be up to date no matter where you use it.

It allows you to deduct recurring transactions from your set budget, set custom categories for your spending, and even get transactions pulled from your banking apps.

Note that this article is not sponsored by Spendee. Now that’s out of the way, let’s dive into the app features.

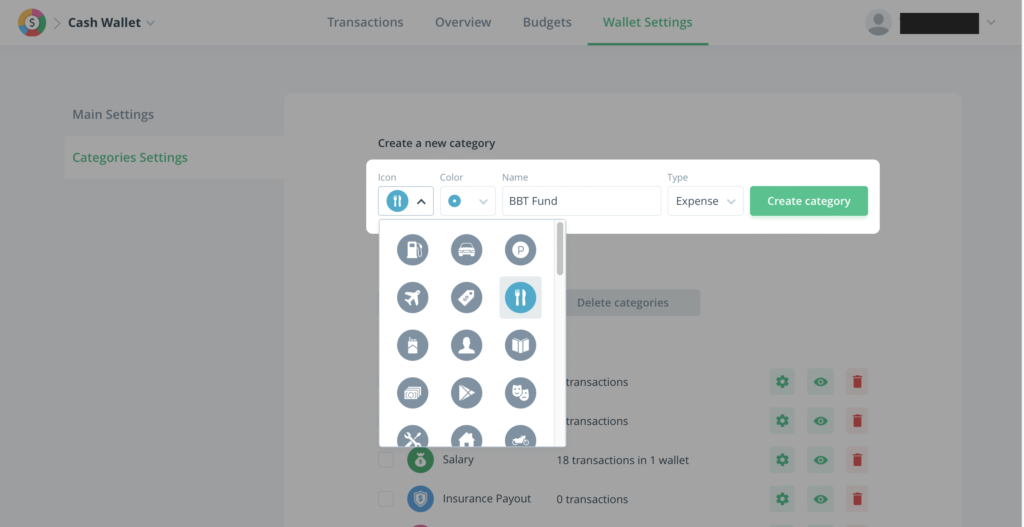

Custom categories

Sometimes not all our transactions fall into the broad categories of Food & Drinks, Entertainment, or Transport.

What if we want to break down exactly how much we spend on Public Transport and our Grab rides? It’s much harder to analyse our spending when we lump both types of transactions together under Transport.

Well, Spendee allows you to create unlimited custom categories for any transaction you want to classify under. It can be anything, from your BBT purchases, Guilty Grab rides, or your Shopee spendings.

What’s more, these categories can be further customised to be either expense or income related. This means that you can record your credit card cashbacks, year-end bonuses and other income streams clearly as well.

These custom categories are included in your monthly statement Spendee sends to your email every month, detailing the percentage you spent on each category. Neat right?

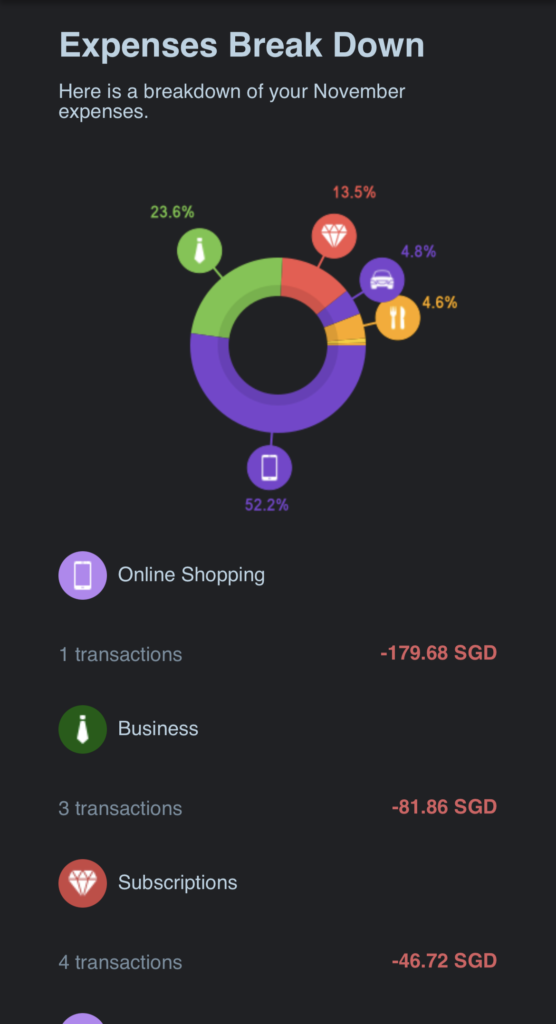

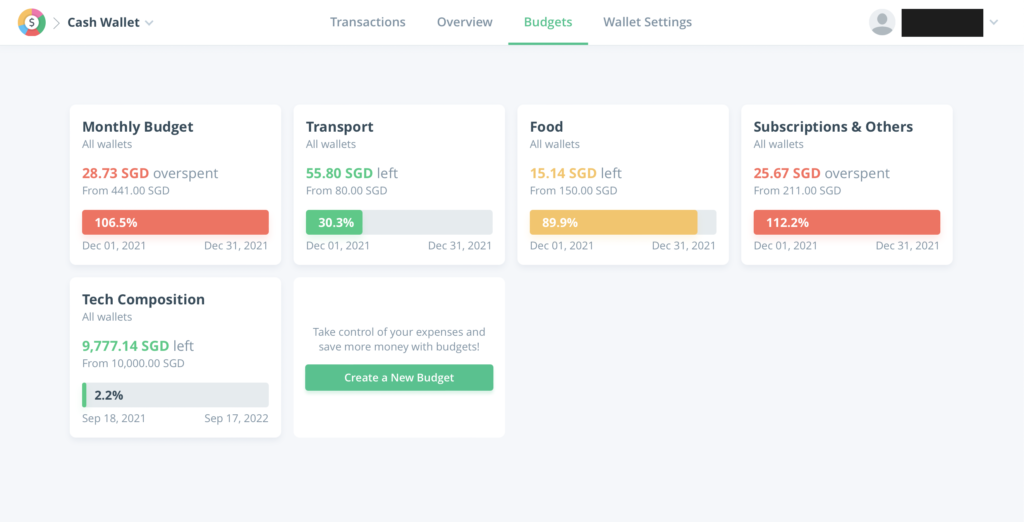

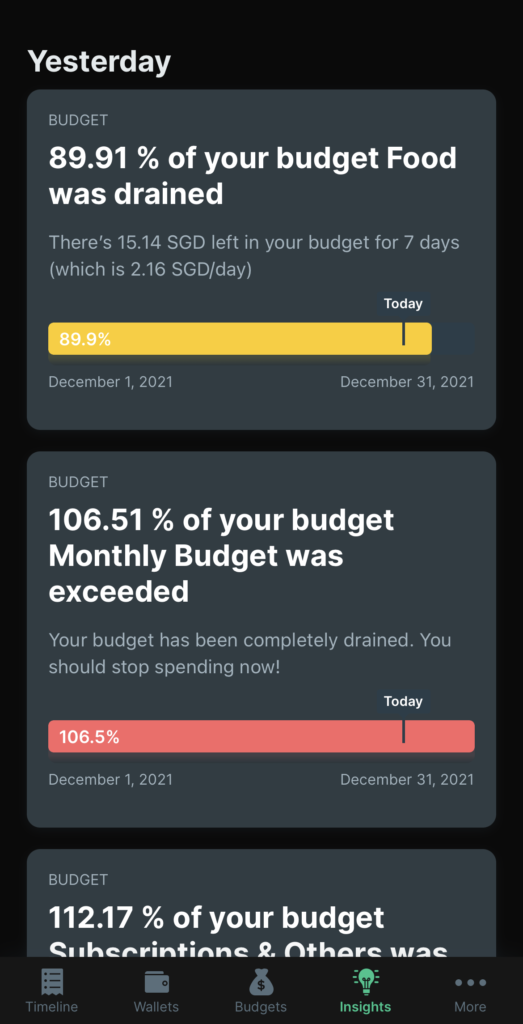

Budgets

Budgets can be set for anything you want: Public Transport, Online Spending, Food and so on. You decide which categories of transactions (custom ones can too) are included in each budget, allocate a sum of money and that’s it.

Anytime you record a transaction in your wallet, every budget that includes that category of spending will be drawn down instantly.

So at a glance, you know exactly how much you have left to spend. If that isn’t enough, Spendee sends you a notification when you are about to exceed your budget and reminds you to stop spending.

Note that while this is a free feature, non-premium Spendee users can only create one budget. The premium versions of Spendee cost $14.99 and $22.99 per year respectively.

But if you are just looking to set a budget for your overall monthly spend, one budget should be sufficient.

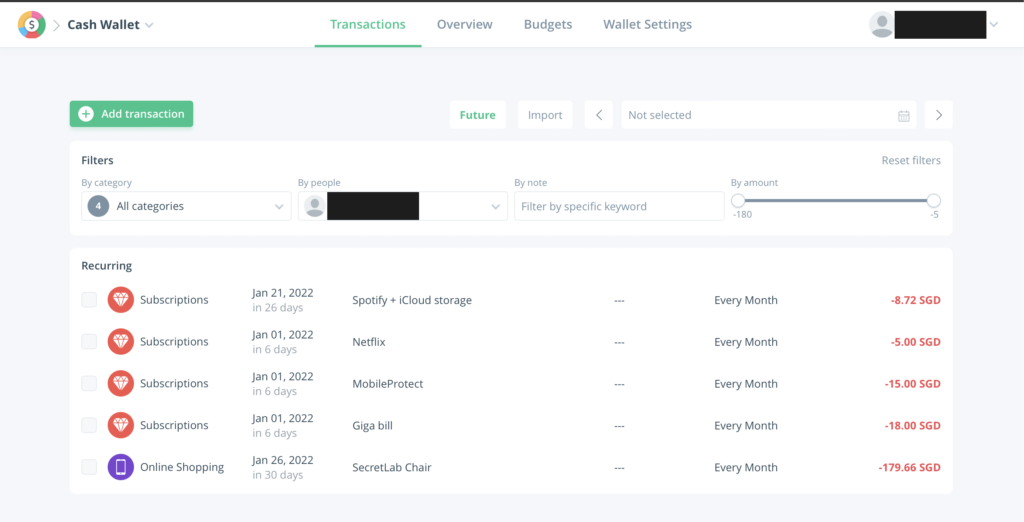

Recurring Transactions

Everything is a subscription now. Your entertainment apps like Netflix and Disney+, your productivity apps like Microsoft Office, and heck, even your everyday purchases can be split into subscription-like instalments.

These monthly subscriptions may seem insignificant when you see them in your bank statements, but they add up.

A S$11.98 monthly Disney+ subscription adds up to S$143.76 over a year, and a S$9.90 monthly Spotify subscription adds up to S$118.80 over a year. You get the idea.

How often do we remember to take these subscriptions into account when we budget our spending for the month? Rarely, right?

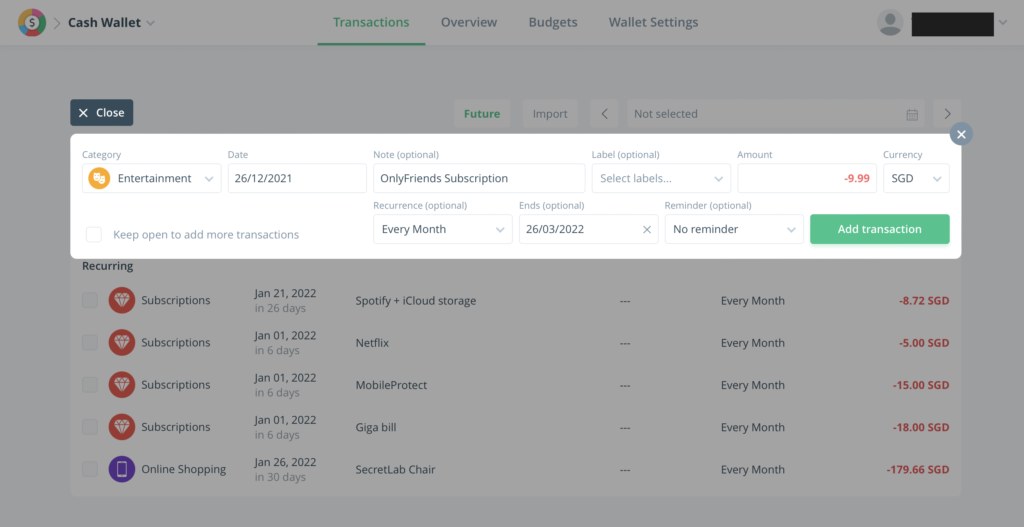

Spendee’s Recurring Transactions feature allows you to set monthly deductions from your Spendee wallet, decide when it ends, and even schedule notifications before your transaction occurs.

The best part is, all recurring transactions are deducted from your budget at the start of every month so you won’t have a false sense of having more money than you actually do.

Take a monthly budget of S$500 for example. If you have S$60 worth of recurring transactions spread out during that month, your budget would show S$440 available rather than S$500 at the start of the month.

By taking the hassle out of logging your recurring transactions, you get a clearer picture of your actual available budget.

Premium

The features don’t just stop here though. If you subscribe to Spendee Plus or Spendee Premium, you get access to features like Bank Account Sync, unlimited budgets and Shared Wallets.

Let me briefly touch on some of these features.

Bank Account Sync

Bank Account Sync allows transactions to be pulled from popular banking apps like HSBC, AMEX, DBS, OCBC, UOB and Citi.

Instead of having to manually record your transactions weekly, they will be automatically imported into your Spendee wallet, and get adjusted in your budgets.

Shared Wallets

If you and your partner want to improve on your financial habits together, having a shared wallet to keep each other in check will work wonders.

By inviting your partner’s Spendee account to your wallet, their transactions will be combined with yours for utmost transparency.

Conclusion

While there are many budgeting apps on the Singaporean App Store like Seedly, and MoneyManager, few come close to how well baked Spendee is.

Spendee is available on web, Android, and iOS. It means you can record transactions and view them anywhere. It offers Recurring Transactions and Custom Categories that other apps may not offer. All these without you needing to pay a cent.

Of course, in order to remain profitable, they had to limit some features like the number of budgets you can create, Shared Wallets, and Bank Account Sync.

But for the vast majority of people, free Spendee is perhaps all you need to keep your finances in check.

Derrick (Yip Hern) founded Tech Composition to provide valuable insights into the tech and finance world. He loves to scour the web for the best deals and embark on software projects during his free time, a typical geek, right?